Floating Offshore Wind Leasing Round 5

Stakeholder engagement

One of The Crown Estate’s core strengths is its ability to bring people together to maximise impact and find shared solutions.

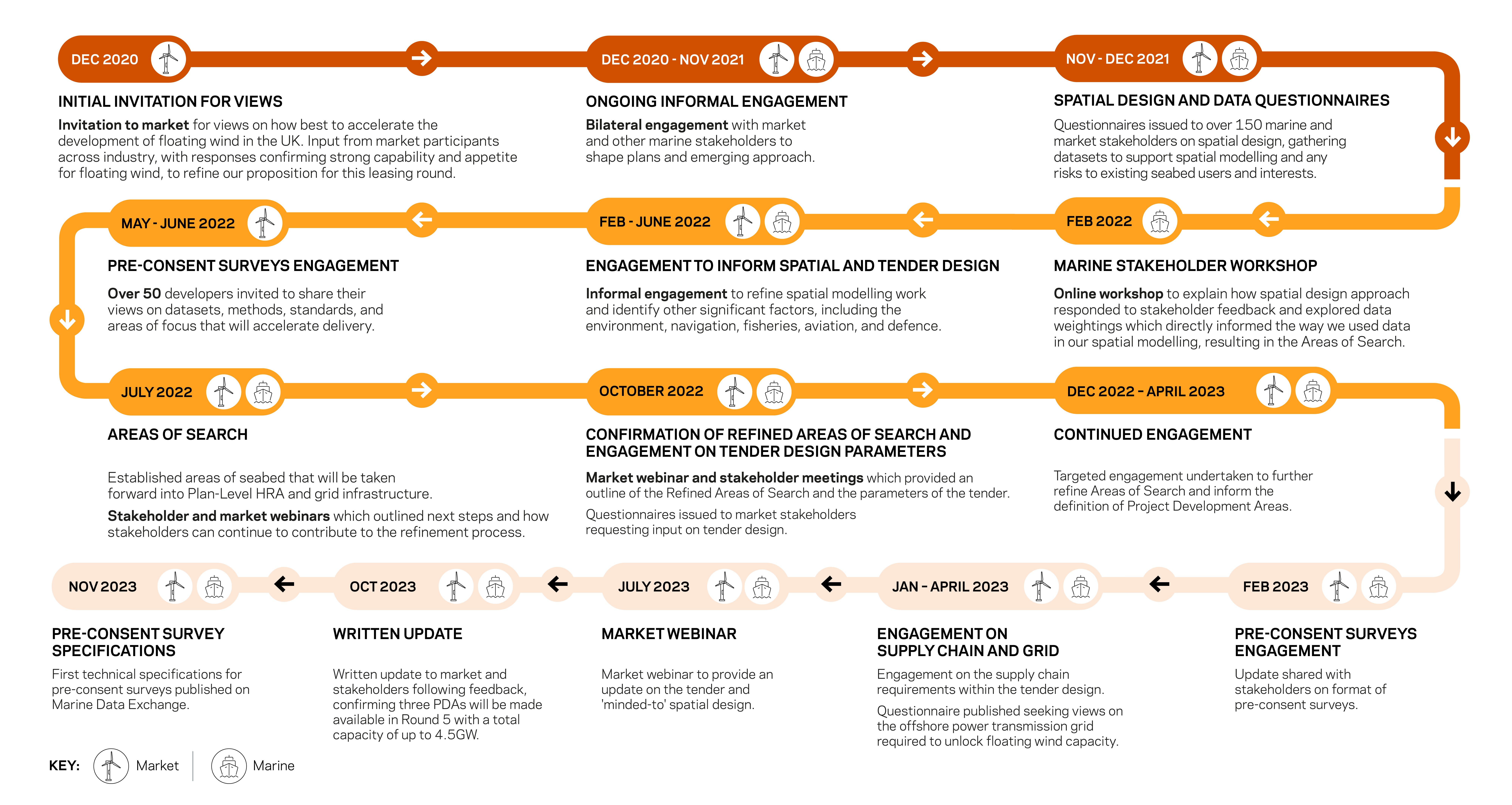

Over the past three years, we have engaged and worked in partnership with UK Government and Welsh Government, offshore wind developers, regulators, statutory bodies and non-governmental organisations representing the interests of the market, Celtic Sea communities, the environment, the fishing and maritime industries, port operators and others, to optimise our design of the Round 5 Programme.

See our previous updates on Round 5 below.

October 2023

In 2021, The Crown Estate first set out plans to explore viable options for a potential leasing opportunity for the first commercial-scale floating wind projects to be located in the Celtic Sea off the coast of Wales and the South West of England. This will be known as Offshore Wind Leasing Round 5, and is expected to be the first phase of development in the Celtic Sea.

The Crown Estate has further refined elements of the leasing round, responding to engagement with the market following our most recent formal update in July. This valuable process has allowed us to make changes to the Round 5 offer to maximise developer flexibility, promote efficient use of the seabed and mitigate development risks.

Market Feedback That Informed This Update

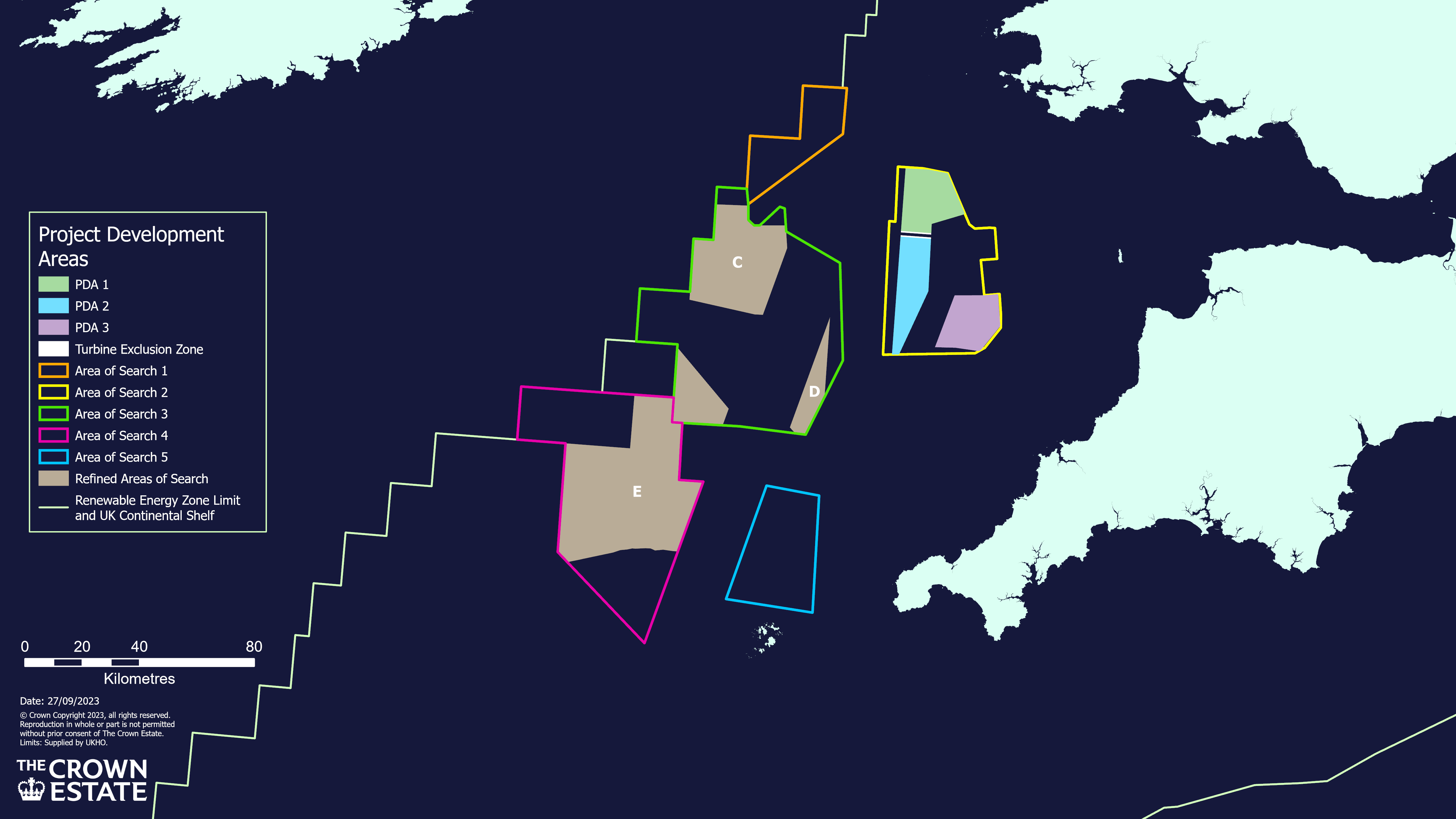

In its July market update The Crown Estate explained that the Celtic Sea is subject to spatial constraints that are under the control of the UK government. As a result of these constraints, we set out how we had focused our attention on delivering Project Development Areas (PDAs) within two of the refined areas of search published in October 2022.

The Round 5 PDAs presented in July sit within an area of the seabed that has been identified and refined through extensive engagement with stakeholders including UK government, and which remains fully agreed with them.

For these reasons, following the July update we asked interested developers specific and targeted questions which were designed to assess at a high level any commercial and technical risks associated with these sites. The feedback we received was comprehensive and detailed, showing significant ambition and enthusiasm on the part of respondents.

Nevertheless, as we expected, respondents made it clear that the final PDAs need careful consideration to maximise value for the sector. A majority of respondents noted the limited spatial flexibility which could impact their ability to respond and adapt their designs to issues that could arise in development.

Points raised through our recent engagement included:

The uncertainty in this emerging market around foundation, anchoring and mooring solutions and optimal array layouts.

The potential impact of telecommunications cables within the PDAs.

The cumulative impacts of closely located projects on the environment and on other sectors like civil navigation.

The potential implications of the proximity of the PDAs on wake effects and on other users of the seabed.

Based on this feedback on the need for greater spatial flexibility given technical constraints, we have revised our minded-to position set out in July.

PDAs and Spatial Design: Update Position

Our minded-to position in July proposed to offer the market four PDAs. Following feedback, we have adapted the spatial offer to three PDAs within the same seabed area, each of which has an enhanced potential capacity of up to 1.5GW. Where previously there was scope to allow a single bidder to win two PDAs, under the revised structure, each bidder will be permitted to win one PDA.

In summary we can confirm that for Offshore Wind Leasing Round 5:

The outer boundary of the area containing the PDAs remains unchanged, as do the key minded-to technical parameters like separation distances between adjacent projects.

Round 5 will bring to market three larger PDAs, rather than four PDAs.

Up to 1.5GW could be feasible in each new PDA, providing up to 4.5GW in total, instead of the previously expected 4GW.

Each PDA will have one winner.

Development of each PDA may occur in multiple projects or phases of at least 300MW as previously advised (up to a maximum of three projects or phases).

The GIS shapefiles of our final PDAs are available here.

Explanation

By having a smaller number of larger PDAs, winning bidders will have greater spatial flexibility to adapt their detailed project designs to account for issues arising in development, both maximising the MW capacity they can deliver and reducing their risk. The decision to refocus the opportunity around three PDAs with more discretion on how the available seabed space is best used, also provides for an increase in the target capacity in each PDA.

With a smaller number of PDAs being offered, limiting a bidder to winning a single PDA both maximises opportunity for all bidders and protects long term competition in the market for future rounds of leasing.

Sharing Data with Developers

You will be aware that The Crown Estate is currently undertaking pre-consent surveys in the Celtic Sea, which will in due course provide data to developers to help them take early decisions and supporting the de-risking and acceleration of their projects. In response to industry appetite to understand more about the data we intend to share, The Crown Estate will publish the technical specifications underpinning these surveys in October. More details on the latest phase of this work is available in our news release accompanying this update.

Developers’ feedback also showed they would benefit from more information regarding wider views among key stakeholders on things like design, planning and consenting risks. The Crown Estate intends to share a range of materials that will support developers in framing their bids. Alongside the Information Memorandum, The Crown Estate will publish:

A summary characterisation report for each PDA it is bringing to market providing details on: environmental, navigation, sub-sea telecoms, fishing, civil aviation, defence, marine plans and any legacy sites uses (disposal sites), plus a short technical summary

A detailed site selection methodology

Summary of marine stakeholder engagement and associated outcomes

Holistic Network Design

The Crown Estate works closely with National Grid ESO in support of their Holistic Network Design Follow Up Exercise (HND FUE) for the Celtic Sea. Through this process we expect that Offshore Wind Leasing Round 5 bidders will have timely visibility of an ESO-recommended offshore network design that facilitates energy export from the PDAs in the most appropriate way, balancing environmental, social and economic factors.

To help expedite the HND Follow Up Exercise, we have already communicated the PDA spatial and capacity information to National Grid ESO and National Grid Electricity Transmission (NGET).

Plan-Level Habitats Regulations Assessment

Similarly, the revised spatial arrangement for the project will inform the Plan-Level Habitats Regulations Assessment (HRA) which is being undertaken alongside the tender process to generate greater momentum and investor confidence.

Following the finalisation of the spatial and capacity offering, our next step involves conducting additional assessments within the HRA framework. Subject to a successful conclusion to the HRA, this process will be completed ahead of ITT1, allowing developers to account for it in their bidding strategies.

Future Pipeline

The Crown Estate recognises that confidence in a future Celtic Sea pipeline will make Round 5 more attractive to developers in an international market and encourage further investment.

We continue to work closely with the UK government with the shared goal of delivering more certainty over the future pipeline as soon as possible. However, the Celtic Sea is a particularly busy area of seabed, and the UK government is continuing its work to resolve a number of competing demands for its use.

Further Requirements for Round 5 Bidders

The Crown Estate outlined to the market in July a range of commitments that will be required of all bidders, ensuring they play a full part in creating the early conditions for long term supply chain success and delivering on the wider economic and social opportunities arising from Round 5. Bidders will be required to show commitments for the timely use of integration ports (used for the integration of the turbine with its foundation before being towed to project sites) that are essential for assembling and deploying floating wind platforms.

Bidders will be expected to make firm and binding commitments to generating positive social impact through their activities delivering Round 5 projects, aligned to the theme of the UK government’s Social Value Model in four key areas:

Employment and training opportunities, particularly for those who face barriers to employment, and dealing with skills shortages;

Tackling inequalities in employment, skills within the workforce delivering projects;

Environmental benefits aimed at working towards net zero, protecting habitats and supporting efforts to enable the transition from carbon-intensive industries.

Working with communities to ensure that benefits are delivered in a manner that involves those communities and is sustainable over time.

Taken together, these commitments will ensure developers play their part in creating a transformative opportunity for communities and businesses in regions where Round 5 projects will be developed and delivered.

Further detail on these elements will be included in the Information Memorandum, which is expected to be published later this year.

July 2023

Following extensive engagement with stakeholders and in response to the feedback, The Crown Estate has been working to develop the tender process for the Celtic Sea floating offshore wind leasing round, which is expected to launch following publication of an Information Memorandum later this year.

On 4th July 2023, The Crown Estate, joined by UK Government and National Grid ESO, updated developers on its intended process, setting out details about the anticipated structure of the leasing round, which is being referred to as Offshore Wind Leasing Round 5. The Crown Estate has also set out the steps it is taking to help de-risk projects ahead of opening to bidders. This includes new spatial constraints that are the subject of an ongoing UK Government review.

As a result of these considerations, The Crown Estate has adapted its approach to focus on two of the Refined Areas of Search previously identified, and published in October 2022 for this initial leasing round, while retaining its ambition to deliver up to 4GW of floating wind through four Project Development Areas (PDA), enough to power around four million homes.

The Crown Estate’s commitment to ensuring projects also deliver economic benefits through investment in jobs, skills and infrastructure means that bidders will be required to set out a number of commitments as part of the tender process, including how they intend to reflect the important role ports will have to play in the assembly and deployment of turbines. New aspects of the tender design will also require developers to set out more detail on how they plan to create lasting social and environmental value, with the introduction of questions linked to the UK Government’s social value model focused on education, inclusion, environment and communities.

To support this announcement and explain what the developed tender process means for the market, The Crown Estate hosted a webinar. Recording, presentation and GIS shapefiles of our Minded-to Project Development Area scenario can be found in the resources below.

The webinar provided an overview of:

The Crown Estate’s ‘story so far’ for floating offshore wind in the Celtic Sea, including how engagement with stakeholders has led to the evolution of the tender design.

Proposed Project Development Areas

The Crown Estate’s proposed leasing model and tendering parameters.

The next steps of the tender process

The webinar invited questions, and feedback on the items discussed.

Following the webinar, we are inviting views from wind project developers so as to finalise the leasing round proposition. By 8 July 2023 we will email a link to a secure digital questionnaire to our primary contacts at wind project developers, for them to respond on behalf of their organisations. This feedback will be collected anonymously. Other developers who may not have previously expressed an interest in our programme can, until the 28 July 2023 deadline, request to view or respond to the questionnaire by contacting Round5@thecrownestate.co.uk.

Please note that all future correspondence relating to Round 5 should be directed to Round5@thecrownestate.co.uk and enquiries will be managed through this inbox.

Offshore Wind Leasing Round 5: July 2023 market update webinar

Market update webinar presentation

GIS shapefiles of our Minded-to Project Development Area scenario

June 2023

Celtic Sea surveys to get underway this summer as The Crown Estate signs new contracts.

Specialist survey vessels are set to embark on a series of studies in the Celtic Sea, after The Crown Estate signed contracts for geophysical surveys as part of a programme to gather valuable data which could help support and accelerate the development of new floating wind farms.

For more detail, read our news page dedicated to this milestone.

May 2023

The Crown Estate updates developers on plans for Celtic Sea floating wind.

March 2023

The Crown Estate conducts further engagement to support implementation of Celtic Sea floating wind

The Crown Estate continues to invite views from offshore wind project developers on its proposals for floating wind in the Celtic Sea. This latest engagement seeks views on the offshore power transmission grid required to help unlock floating wind capacity.

Throughout the process, The Crown Estate has sought the views of market and other stakeholders to help shape the Celtic Sea leasing round. Realising a robust offshore power grid is a shared challenge, and these views will help to inform The Crown Estate’s approach to supporting this through the leasing process.

This questionnaire closed on 14th April 2023. Our thanks to those who took the time to respond.

February 2023

The Crown Estate conducts further market engagement on its programme of pre-consent surveys for the Celtic Sea

In December 2022, The Crown Estate announced it had awarded the first contracts as part of a series of technical and environmental surveys around potential locations for new floating wind farms in the Celtic Sea.

On 1 February 2023 The Crown Estate presented an update on this work to floating wind project developers at a webinar hosted by Marine Energy Wales.

The webinar provided further technical detail on the planned surveys and also seek feedback from developers on the survey programme.

You can watch the webinar and view the presentation slides in the resources below.

Celtic Sea Floating Wind Feb 2023 update webinar

Celtic Sea Floating Wind Feb 2023 update presentation

January 2023

The Crown Estate is inviting views from project developers and regional ports on its plans to help realise the benefits of floating wind technology in the Celtic Sea.

This engagement seeks views on supply chain requirements to help unlock an initial 4GW of floating wind by 2035, and which of these necessitate priority investment. It also explores the technological innovations and skills that are critical to accelerating the delivery of this project, as well as the importance of proximity to the final project location.

The Crown Estate values the views of market and other stakeholders in shaping the Celtic Sea leasing round. Realising the wider supply chain benefits of a successful floating wind industry in the Celtic Sea is a shared challenge, and these views will help to shape The Crown Estate’s approach to supporting this through the leasing process.

We have emailed our primary contacts at project developers and regional ports to respond on behalf of their organisations. Other developers and port operators who may not have previously expressed an interest in our programme can, until the deadline, request to view or respond to the questionnaire by emailing offshorestakeholder@thecrownestate.co.uk.

December 2022

The Crown Estate accelerates plans for floating offshore wind in the Celtic Sea with multi-million pound programme of marine surveys .

The Crown Estate has awarded the first contract to carry out an initial phase of what is anticipated to be a multi-million pound series of technical and environmental surveys around potential locations for new floating wind farms in the Celtic Sea.

The initial phase of metocean surveys will begin in Spring 2023, and The Crown Estate is progressing the procurement of the remaining surveys, including geophysics, geotechnical, and birds and marine mammal surveys, over the coming weeks and months.

By investing in these at an early stage and making the data freely available to successful bidders, The Crown Estate is aiming to accelerate the delivery of projects, making it easier for developers to take early decisions and manage risk, while supporting future project level Environmental Impact Assessments (EIAs) as part of the planning process. It is also hoped the programme will avoid the need for developers to conduct additional surveys later in the process, while making best use of limited specialist survey resource.

Throughout the past year, The Crown Estate has been collaborating with technical advisors, industry, and other stakeholders including statutory nature conservation bodies, to develop a robust programme of surveys to provide useful datasets for developers. The specifications will be continuously reviewed throughout the programme, but will cover a range of important areas, including the geophysical and geotechnical properties of the seabed, metocean (wind, wave and current patterns), and marine wildlife.

All datasets will also be made freely available in due course, through The Crown Estate’s Marine Data Exchange, the world’s largest resource of marine industry survey data, research, and evidence. To find out more information about our programme of marine surveys, see our press release, and to read more about our work in marine data and evidence, see here.

October 2022

On 10th October 2022, The Crown Estate provided the market with new information on its proposals for leasing for floating wind in the Celtic Sea.

The Crown Estate has advised developers that, as part of their participation, they will be expected to provide a plan of their early investment in support of an internationally competitive supply chain. Submission of these plans, alongside other legal, financial and technical elements, will determine whether participants qualify for proceeding to the final stage of the tender.

The Crown Estate also published ‘Refined Areas of Search’. The original Areas 1 and 5 have been removed from current consideration, while five smaller areas have been identified within Areas 2, 3 and 4, after engagement with multiple stakeholders.

To support this announcement and explain what this means for market, The Crown Estate hosted a webinar.

The recording and presentation from the webinar can be found in the resources below.

The webinar provided an overview of:

Our approach to floating offshore wind in the Celtic Sea, and the progress made since the July market and marine stakeholder updates

Refined Areas of Search, and the steps and engagement taken to identify these

How The Crown Estate will be further refining these into smaller Project Development Areas

Our proposals for the leasing tender design, and how this process will develop

The timeline through to the end of 2024

The webinar invited questions, and formal market feedback on the items discussed.

If you are a potential market participant and were unable to attend this event, and/or you would like further information, please contact us at offshorestakeholder@thecrownestate.co.uk

July 2022

On 5th July 2022, The Crown Estate announced the Areas of Search for the development of floating wind in the Celtic Sea.

These areas have been identified following technical analysis and extensive engagement with market, marine and statutory stakeholders.

Engagement is at the core of The Crown Estate’s approach to floating offshore wind and further feedback will be sought as we refine the Areas of Search into smaller Project Development Areas capable of containing a gigawatt scale project.

To support this announcement and explain how stakeholders can continue to contribute to the refinement process, The Crown Estate hosted two webinars on Thursday 7th July 2022 for its market and marine stakeholders, respectively.

The recording and presentation for both webinars, and a summary of the Q&A, are available in the resources below.

The webinars provided an overview of:

Our approach to floating offshore wind in the Celtic Sea

How we have engaged with stakeholders and how this has shaped our work

Our approach to and progress on the spatial design of floating wind in the Celtic Sea

Initial Areas of Search and how The Crown Estate will be taking these forwards and further refining them into smaller Project Development Areas

Next steps and how stakeholders have been asked to give feedback

If you are a potential market participant and were unable to attend these events, and/or you would like further information, please contact us at offshorestakeholder@thecrownestate.co.uk

Market stakeholder webinar recording

Marine stakeholder webinar recording

Marine and market stakeholder webinars Q&A summary

March 2022

We have now completed phase two of our ongoing engagement with the market and stakeholders.

Last month, we hosted a workshop attended by over 70 stakeholders with an interest in the Celtic Sea, including representatives from environmental, fishing, marine and ports organisations, as well as Government. Presentation and summary of the workshop can be found in the resources below.